What is Open Banking?

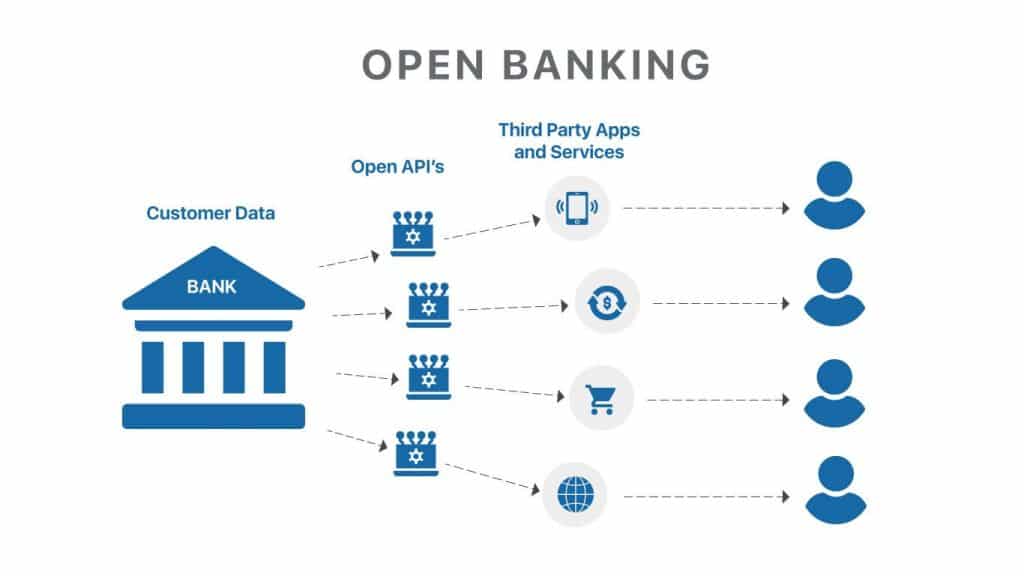

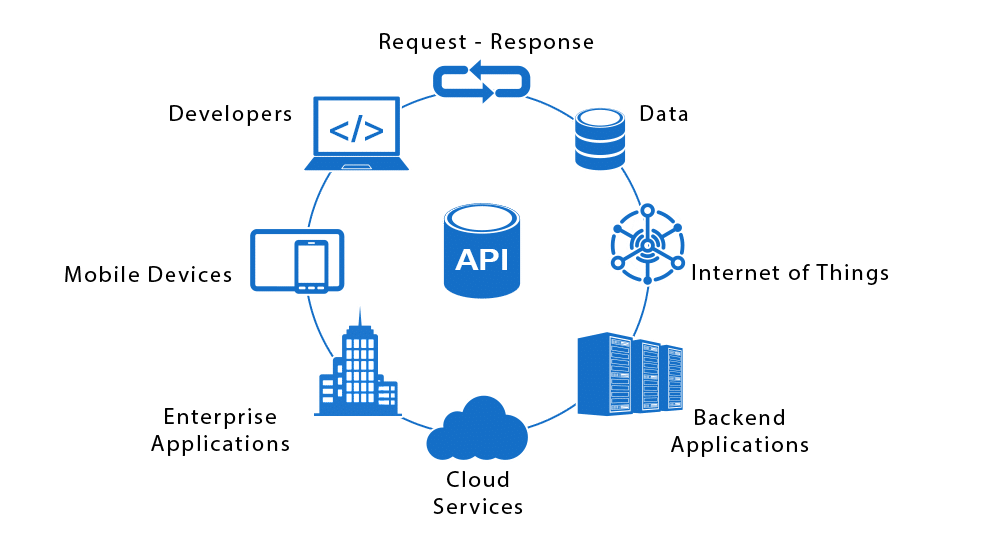

Open Banking regulations allows big banks to provide their customers’ transaction data- with their consent- to third parties, which is made possible through application programming interfaces or APIs. These APIs allow software at one company to have access to information from another. In order to make use of bank APIs, companies have to gain authorization from national regulators such as Account Information Service Providers (AISPs), proving compliance with regulations including keeping data secure and only using access to provide their declared service.

This means that people can have a safe channel to easily share their banking information with other companies. Thanks to it – always with each individual’s consent–, these companies can use banking data to build new financial products and services that are linked to users’ banking accounts and that are more tailored to their specific financial situation and needs.

Adoption to Open Banking

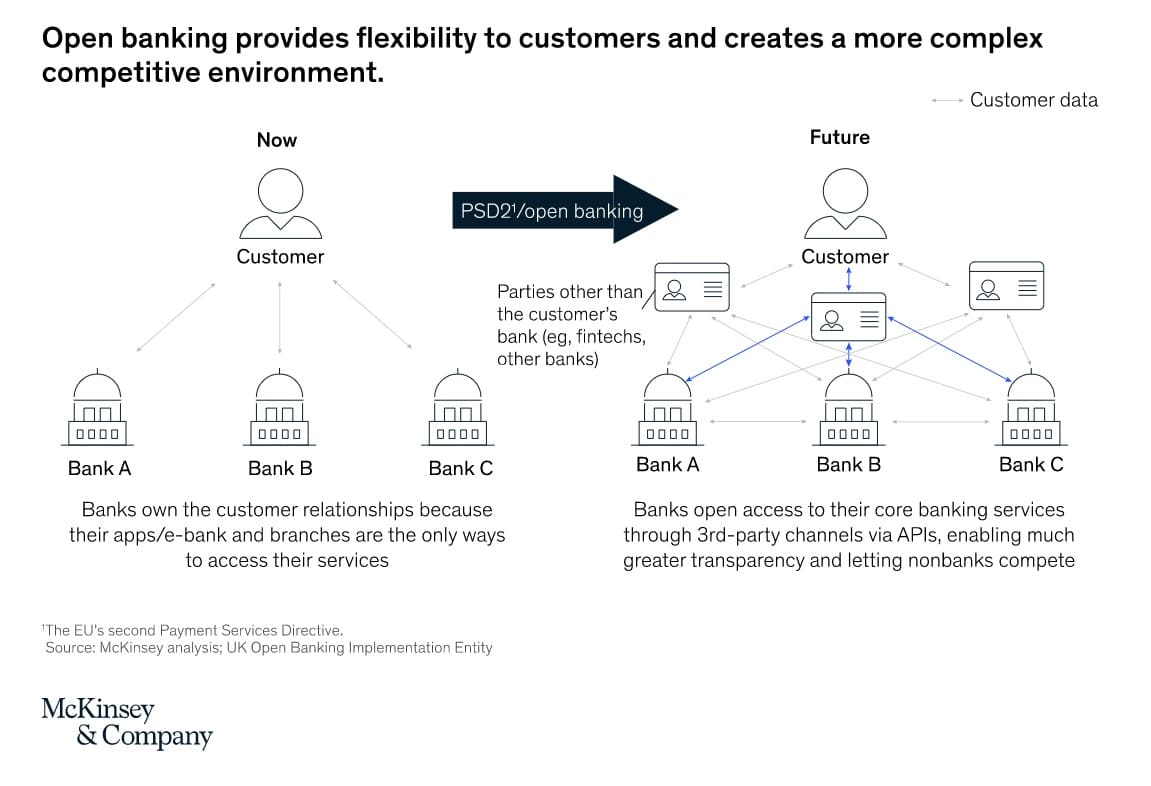

Around the world, this trend is evolving in different ways. In the European Union, the United Kingdom, South Korea, Australia, and India, governments have mandated large banks to open up their vast troves of customer accounts to other companies, in a bid to stimulate competition. In the United States and China, it is a market-led movement, with companies establishing open-banking relationships among themselves. Singapore is using a blend of the two models.

But according to Forbes “Open Banking has yet to experience full adoption, as some banks are taking time to deal with potential compliance issues and haven’t taken full advantage of the changes in legislation.” Some experts believe it’s not of the banks’ benefit to promote open banking, since they are reluctant to give away a large amount of valuable data to third-party providers while receiving little in return. As a result, many established banks are not in favor of embracing new technologies.

There is also resistance on the consumer side, as people concerned about sharing their data following the Cambridge Analytical, as well as a failure to see a significant benefit. Nevertheless, PWC predicts 71 percent of SMEs and 64 per cent of adults will adopt open banking by 2022.

Beyond Open Banking

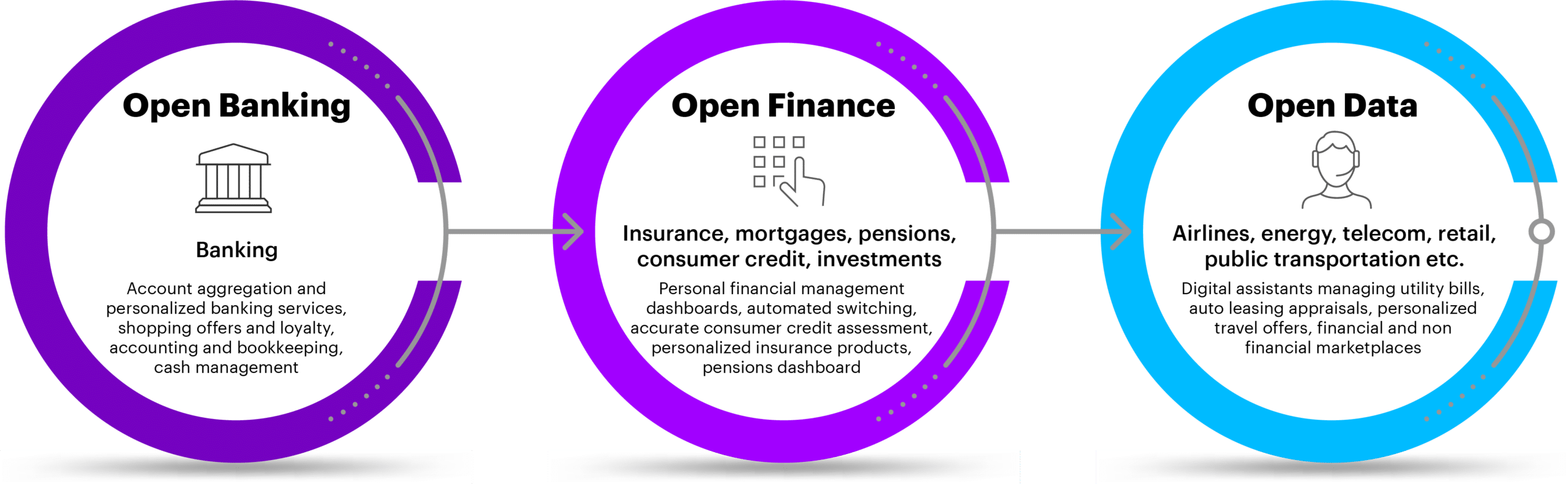

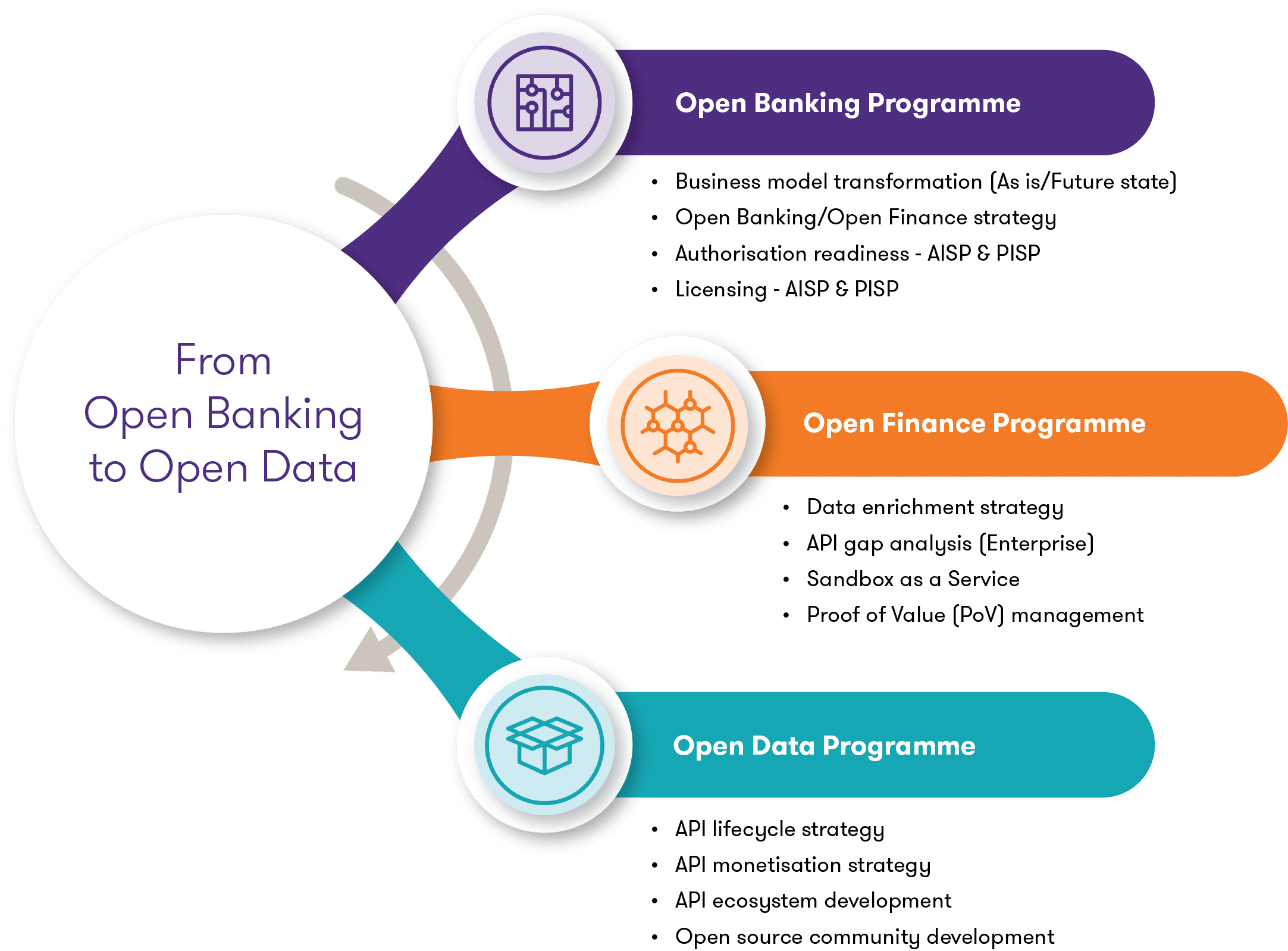

According to Finextra “The financial services industry is already looking beyond open banking to open finance, or what Capgemini referred to as ‘Open X’ in the Capgemini World Retail Banking 2019 report. industry players are being encouraged to priorities effective and structured collaboration, facilitated by API standardization and shared customer data insights. In turn, this will create an integrated marketplace, where seamless exchange of data and services will occur, improving customer experience, and expediting product innovation.”

Open financial Data

Open financial data could put powerful non-bank companies in a stronger position to become financial-services players. This opens the possibility for them to be the first port of call for new financial products and services to their user bases, similar to what Google now enables customers to do with its “Plex” product, connected to the Google Pay app. According to the Google web site, Plex is offered in partnership with 11 banks and credit unions and includes physical and virtual debit cards, peer-to-peer payments, and an associated checking account. In Singapore, the government recently issued banking licenses to five nonbanking players, including the consumer ecosystem Grab (200 million users in eight countries) and the consumer internet company Sea. The surge in online activity and digital behaviors has also opened up new avenues for companies to integrate financial services directly into customers’ daily activities, such as online shopping and the management of payments related to cars.

By utilizing APIs, financial institutions can implement open finance solutions to improve the customer experience and offer customers greater product choice and control over their finances and data. With a cloud provider, customers can build APIs across multiple micro-services that interact with third parties quickly and connect with them in a simple way.

Fintech firms have developed open finance solutions that complement cloud-based open API platforms and provide the solutions financial institutions need. With the cloud, financial institutions can scale APIs on demand, pay only for what they consume, and build modern server-less architectures. Building open finance solutions on the cloud requires minimal capex and investing in this technology today will help financial institutions get a step ahead of industry peers.

Open Finance

Yet, the transformation didn’t stop there. In regions where a big percentage of the population is still unbanked or underserved, such as Latin America, the potential impact of Open Banking was limited. Because, in absence of banking data to connect to, people would still not be eligible for the newly created products and services.That’s why as Open Banking regulation evolved, a new concept emerged in some countries like Mexico, where authorities decided to extend the scope of this model to other financial information beyond banking.

“In Mexico, we decided to call it Open Finance because all financial entities will have to share data through standardized APIs, not only banks. This will cover over 2,000 financial providers,” explains Dorian Loyo, an expert at the National Banking and Securities Commission (CNBV) of Mexico.

Cloud Open Banking

As new business models emerge with recurring revenue in the innovative payments sector, traditional banks are looking to utilize open banking and open finance to assist with their digital transformation.

Consumers need real-time, instant, and faster payment capabilities, and with open banking, PISPs are providing alternative methods of payments with a single API connection. Whether banks are providing alternative payments methods or not, this shift to a digital economy will continue and will result in an attraction to a platform where financial data can be used to offer value-added services to other industries.

New sources of data

Thanks to this evolution towards Open Finance, data from multiple sources beyond banking can help build innovative and more inclusive financial services. This includes financial data from digital players like big tech companies, fin-techs, or gig economy platforms, as well as traditional entities like fiscal institutions, insurance issuers, retailers, or even utility providers like electricity companies.

“Whether that’s someone paying a power bill monthly or phone or water, that’s a transaction being made. And that data can be leveraged in many ways to enhance people’s financial lives in terms of having access to new services,” explains Tory Jackson, Head of Business Development and Strategy, Latin America at Galileo.

Financial Inclusion

These new alternative sources of non-bank financial information can help financial innovators get a wider view of the population’s real financial activity and needs. One that actually describes their daily transactions, even if they don’t take place in a bank. As a result, companies’ potential customer base increases, as it does their ability to develop more relevant and tailored services for them.

It means that users can share their financial data –no matter where it comes from– with third parties through APIs to access new added-value products and services that are tailored to their specific needs.

It gives users real ownership of their data, and freedom to decide how and when they want to access and manage their financial data, whether that’s inside their mobile banking app or any other tool they use in their daily lives.

Open Finance is also where the potential for building truly innovative financial services becomes a reality, as it offers the chance to create completely new business models that leverage previously unexplored sources of data.

A specific example of how this works is minu. This Mexican company is using data from gig economy platforms to build innovative financial services for their workers, thanks to Open Finance APIs.

The depth and width of financial impact

Experts believe that two factors could determine the size and depth of open financial data’s impact—the types of products included in scope and whether the regulations for APIs allow customers to take action with their data as opposed to just viewing it. The type of API allowed by regulators also varies around the world. For example the UK open-banking rules include both the ability to view data (read) and the ability to interact with it (write) in ways that unlock use cases such as the seamless movement of money or switching to a different product or provider. In Australia, by contrast, third parties can only view customer data.

If customers can easily interact with their data across a broader range of products and seamlessly switch, it is likely to result in greater churn and margin compression—posing a threat to incumbent banks and creating an opportunity for new entrants such as fin-techs and tech giants. It will be important for banks to calibrate their current actions on open banking against their views on the likelihood of this outcome materializing.

Gathered and Revised: Forough M.Salehi

References:

1. How Open Banking Has Changed Financial Services So Far; by: Vishal Marria, Dec 10, 2018,

2. Progression beyond open banking to open finance; By Madhvi Mavadiya, Oct 29, 2021,

3. Open Finance: what is it and how is it different from Open Banking?; Mar 05, 2021,

4. Open Banking powered by the Cloud, Democratising Finance at Scale;

5. Financial services unchained: The ongoing rise of open financial data; By Chandana Asif, Tunde Olanrewaju, Hiro Sayama, and Ahalya Vijayasrinivasan; July 11, 2021,